Nama completes wind-down programme with final €450m transfer

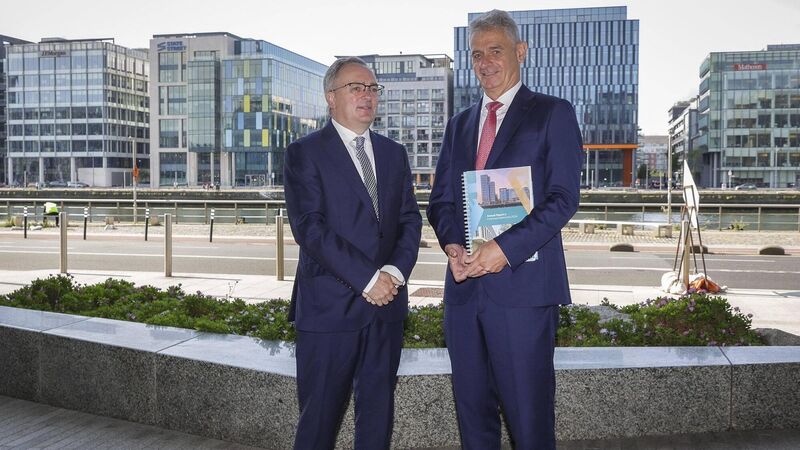

NAMA Chief Executive Brendan McDonagh and NAMA Chairman Aidan Williams. The National Asset Management Agency (Nama) said on Wednesday it has completed its wind-down programme, paving the way for its formal dissolution after legislation is enacted. Picture: Fennell Photography

The National Asset Management Agency (Nama) said on Wednesday it has completed its wind-down programme, paving the way for its formal dissolution after legislation is enacted.

On Wednesday, the agency completed a transfer of €450m in cash to the Exchequer, bringing total transfers of cash and other assets from Nama to the State to €5.6bn, of which €875m - €450m cash, and property assets of €425m to the Land Development Agency - was transferred during 2025.