Ireland inches closer towards hydrogen roll-out through potential agreement with France

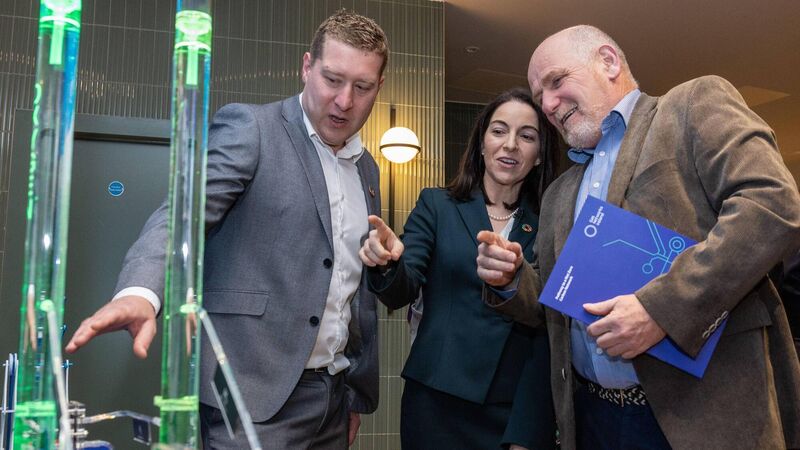

Gas Networks Ireland's hydrogen technical manager, Wayne Mullins, showing a demo model of hydrogen generation through electrolysis to chief executive, Hydrogen Ireland, Paul McCormack and head of customer care and communications, Gas Networks Ireland, Kate Gannon.

Ireland’s burgeoning renewable energy industry, among others, continues to be rocked by tariffs and trade wars, which have created caution among investors and dealmakers.

However, despite global turmoil, an agreement between Ireland and a European neighbour looks increasingly likely in relation to hydrogen roll-out.