Explainer: What is Jackson Hole and why is it important?

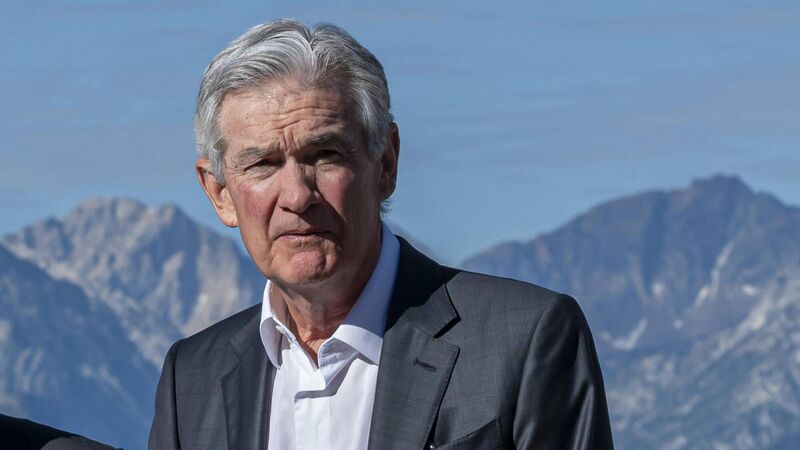

Jerome Powell, chairman of the US Federal Reserve, at the Jackson Hole economic symposium in Moran, Wyoming, US, on Friday, Aug. 25, 2023. Photographer: David Paul Morris/Bloomberg

Jackson Hole is a remote valley located in the rural US state of Wyoming. Known for its beauty and wildlife, the area comprises ski slopes, a national park and natural hot springs, making it a major tourist attraction.

In addition to its outdoorsy visitors, for more than 40 years, Jackson Hole has been home to the Federal Reserve's annual three-day economic symposium, hosted by the Federal Reserve Bank of Kansas City.