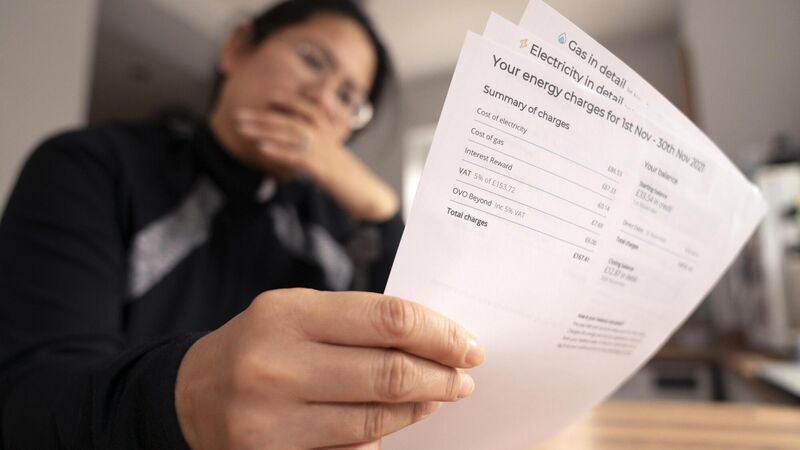

Why our struggle with energy price hikes is far from over

Despite the reduction in Vat, most households will still be paying more in tax to the Government each month than they were in late 2020, right before the energy crisis started to unfold.

Four in 10 households are struggling to afford everyday home energy needs, while a further two in 10 could not withstand further price increases, however small. And as overall inflation reaches a 21-year peak of 6.7%, a survey from Taxback.com reveals that 80% of the Irish public plan to make changes to their household buying behaviour.