Michael Fingleton allegedly authorised loans without board seeing application, court hears

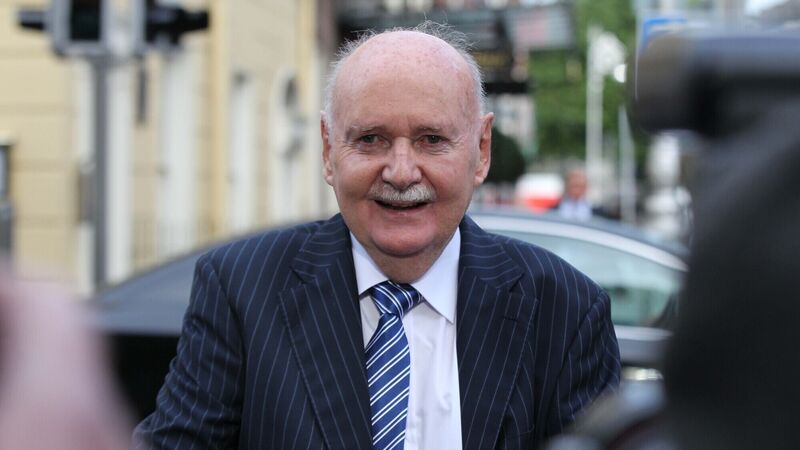

Liquidators for Irish Banking Resolution Corporation (IBRC) have taken the case against Michael Fingleton, who denies the allegation of negligent mismanagement. Picture: Stephen Collins/Collins Photos

The civil case against former Irish Nationwide Building Society (INBS) chief Michael Fingleton is in its third day before the High Court, where it has been alleged that he negligently mismanaged the building society and engaged in property “gambles” with high net-worth individuals in an informal and speculative manner.