Sale of 'equine jewels' helps Goffs to record ring turnover of €238.3m

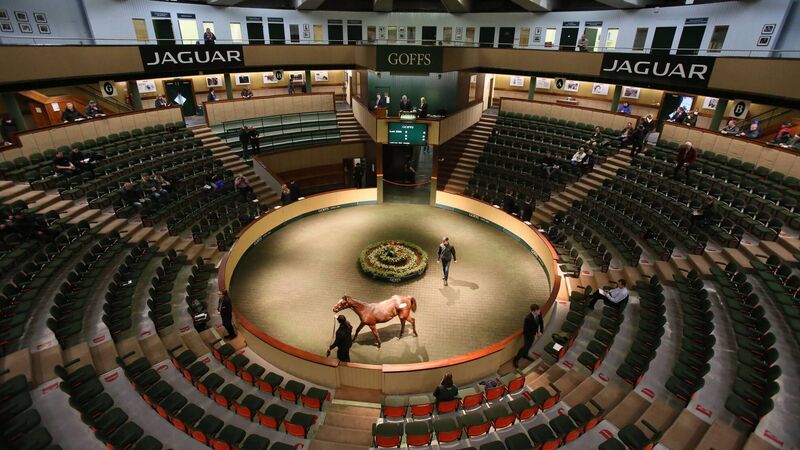

At the Goffs November breeding stock sale, Group One winning siblings, Alpha Centauri and Alpine Star were part of a significant draft of the Niarchos family’s bloodstock and were snapped up by John Magnier’s Coolmore for a record €6m each in a €19m spree by Coolmore. Photo: Paul Faith/AFP/Getty Images

The sale of “equine jewels” at Goffs helped the bloodstock auctioneering business to achieve record ring sales of €238.3m in its latest financial year.

New accounts for Robert J Goff & Co plc show on the back of the record ring turnover, which included the sale of the world's two highest priced thoroughbreds of the year, pre-tax profits increased by 59% to €3.6m in the 12 months to the end of March this year.