Nvidia shares jump 6% in after-hours trading as chip designer earnings deliver on AI promise

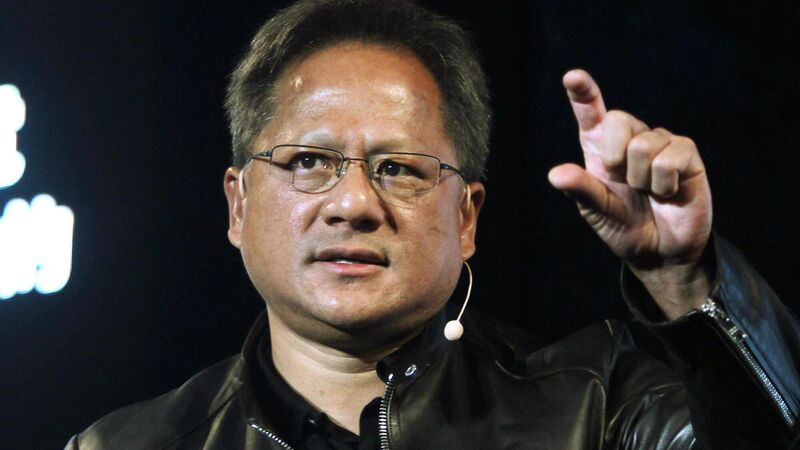

Nvidia chief executive Jensen Huang.

US chipmaker Nvidia, which has been at the heart of the frenzy around artificial intelligence that has helped fuel a remarkable rally for global stock markets, posted quarterly earnings that beat analyst expectations. Its shares jumped more than 6% in after-hours trading on Wednesday night.

The latest earnings of Nvidia have come under intense scrutiny on concerns of some analysts that the stock market bubble around AI-linked shares was about to burst.