Bankman-Fried fraud verdict: Beginning of the end for crypto?

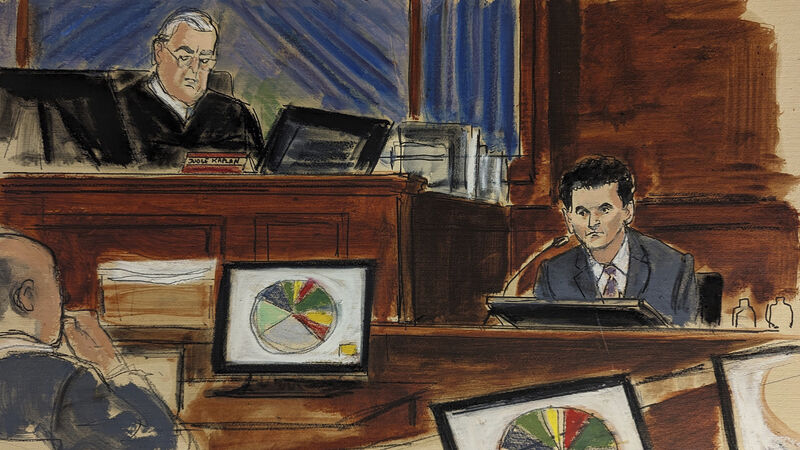

In this courtroom sketch, FTX founder Sam Bankman-Fried, right, testifies as judge Lewis Kaplan, upper left, presides during his trial in Manhattan federal court. His lawyers tried to cast him as a ‘math nerd’ who was in over his head and tried to blame Caroline Ellison and rival cryptocurrency exchange Binance for FTX’s collapse