Soft iPhone sales fuel concerns for Apple

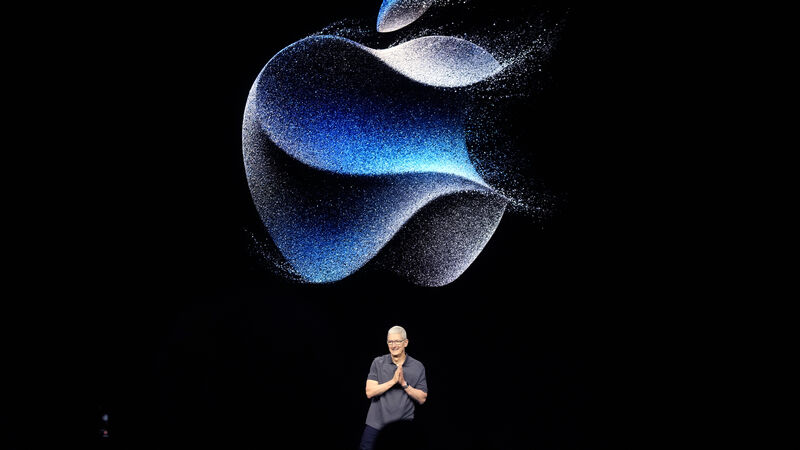

Apple CEO Tim Cook speaks during an announcement of new products in September. Picture: AP/Jeff Chiu

A drumbeat of bad news for Apple is casting doubt on the argument that the world’s most valuable company is immune to risks related to economic turbulence.

Tepid sales in China for its new iPhone models have fuelled concerns about Apple’s ability to justify its pricey valuation and avoid a streak of four consecutive quarters of falling revenue — which would be its worst run since 2001.