Pre-tax losses at firm behind Kildare Village almost double to €6.48m

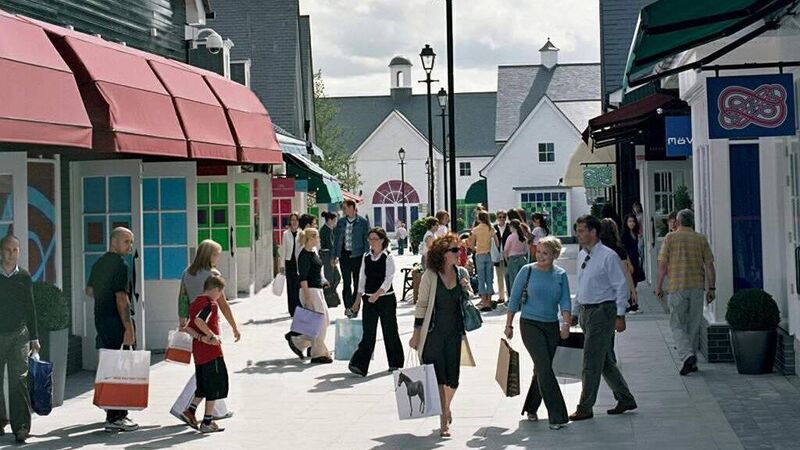

Kildare Village was closed in line with Covid-19 restrictions for certain periods in 2020, and also during the early months of 2021. File Picture.

Pre-tax losses at the firm that operates the shopping destination, Kildare Village, last year almost doubled to €6.48m.

According to new accounts filed by Value Retail Dublin Ltd, the firm’s pre-tax losses increased sharply as revenues slumped by 37% from €15.66m to €9.86m.