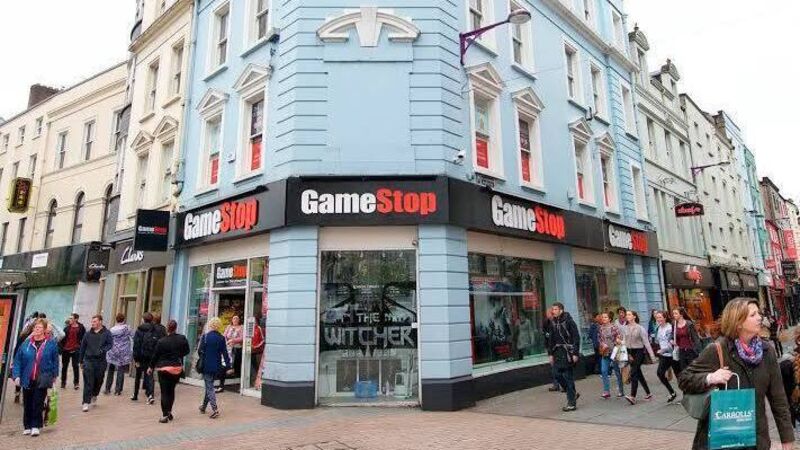

GameStop shares sink, price of silver falls as Reddit frenzy fizzles out

US videogame chain gameStop’s shares were down 54% at $106 in late trading scaling a high of $483 last week.

Shares of the US videogame GameStop sank and the buying spree for silver led by small investors subsided as the Reddit-driven trading frenzy that has shocked global financial markets over the past week started to show signs of fizzling out.

The US videogame chain’s shares, which have see-sawed in a slugfest that has seen billions of dollars gained and lost by hedge funds and other financial investors, were down 54% at $106 in late trading scaling a high of $483 last week.