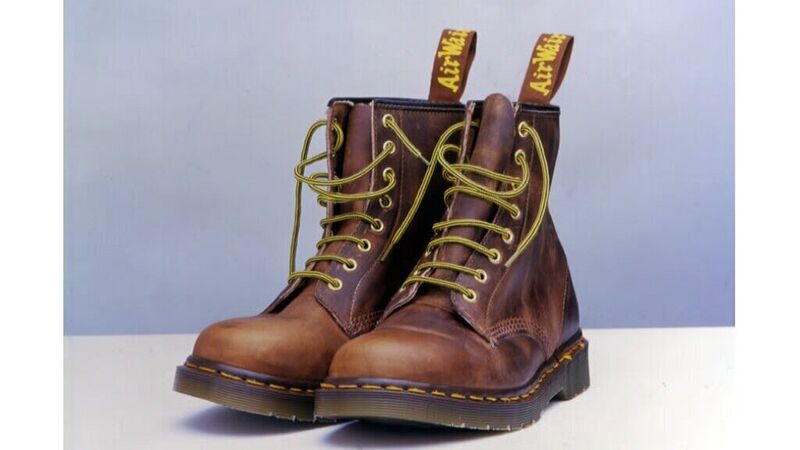

Dr Martens raises €1.5bn

Dr Martens' IPO values the bootmaker at more than €4bn

Classic boot brand Dr Martens kicked off its London IPO in style, attracting bumper demand in a sale valuing the company at more than €4bn that is likely to spur other British companies to follow suit.

Dr Martens’ shares were up 16% in their market debut after the company priced the deal at the top of an indicative range at 370 pence, raising nearly £1.3bn (€1.5bn) and giving it a market capitalisation of £3.7bn.