No-deal Brexit could see 10,000 jobs go in Irish tourism industry

Approximately 10,000 jobs could be lost in Ireland's tourism industry in the event of a no-deal Brexit, according to the Chair of the Drinks Industry Group of Ireland (DIGI).

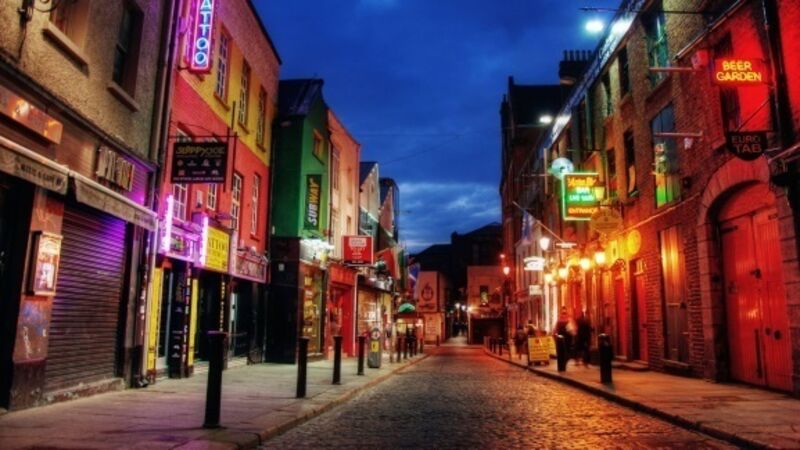

Rosemary Garth explained that the tourism industry is driven by the country's drinks and hospitality sector which employs almost 8% (270,000 people) of the country in pubs, restaurants, hotels, breweries and distilleries. She added that most of the sector's employees live and work in rural Ireland.