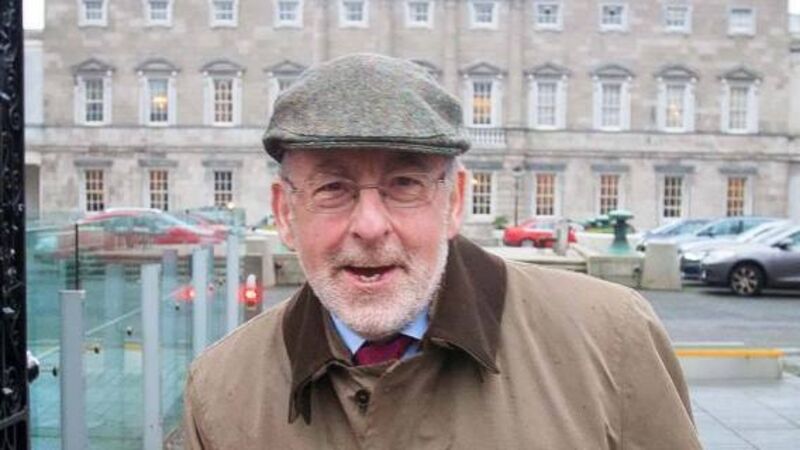

Cost of servicing bad loans still ‘too high’ according to Central Bank governor Patrick Honohan

In a wide-ranging speech to the London School of Economics on Ireland’s banking and property bust and the lessons learned from the bailout and recovery, Mr Honohan said that the country may have escaped “the error” of pressing for too many home repossessions that could possibly have made matters worse.

The speech is likely to be one of his last as he prepares to step down from the top job after steering the Central Bank through the crisis years.