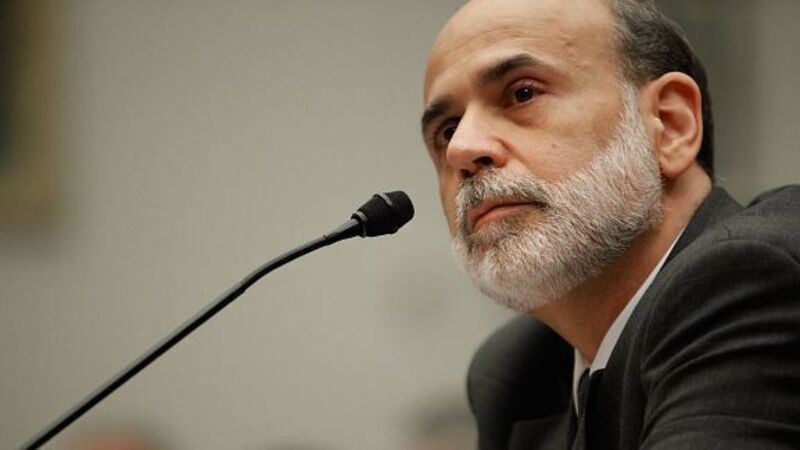

Bernanke: No set timetable for ending stimulus

“Conditions in the job market today are still far from what all of us would like to see,” chairman Ben Bernanke said at a press conference in Washington yesterday after a two-day meeting of the Federal Open Market Committee. “The committee has concern that rapid tightening of financial conditions in recent months would have the effect of slowing growth.”

Bernanke and his colleagues held back from paring record accommodation as rising borrowing costs show signs of slowing the four-year expansion. Treasury yields have jumped since May, when Bernanke first outlined a possible timetable for a reduction in the asset purchases that have swelled the Fed’s balance sheet to $3.66 trillion.