Jim Power: Spending increases the big story in Budget 2026

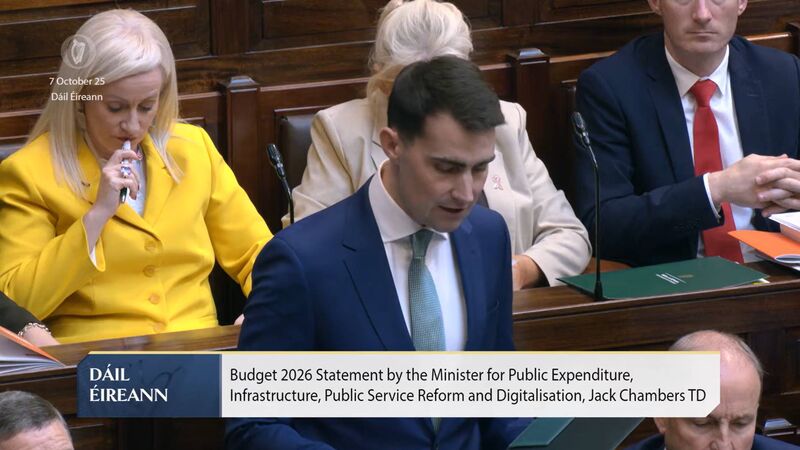

The expenditure was spread generously across all departments, and the quick-fire way minister Jack Chambers rolled off the increases was impressive.

The days leading up to Budget 2026 were overshadowed by presidential politics.

It was probably just as well for the two parties of government, because despite the size of the budget package, workers will not benefit very much, if at all, from the offering. In fact, workers will experience a stealth tax increase due to the failure to widen the bands and credits, which has been a feature of recent budgets.