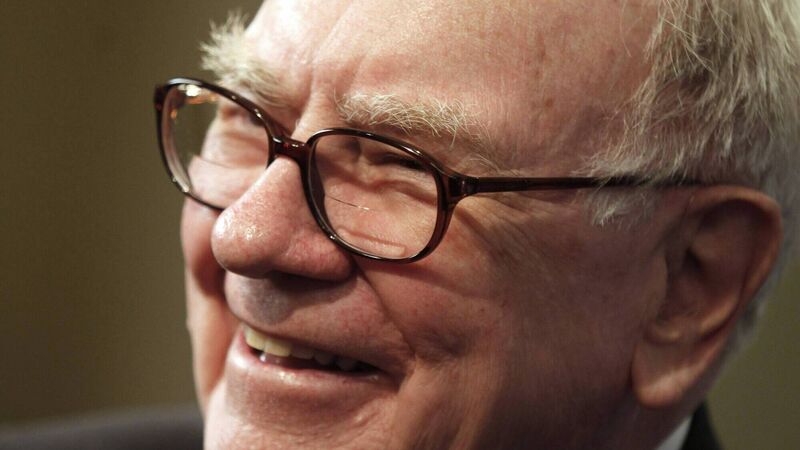

Warren Buffett switches investment focus from US to Japan

Berkshire Hathaway has bought a 5% stake in each of Japan’s five biggest trading houses, together worth over $6bn (€5bn), marking a departure for chairman Warren Buffett as he looks beyond the US to diversify his conglomerate.

The long-term investment in Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo could see the stakes rise to 9.9%, Berkshire said at the weekend as Mr Buffett celebrated his 90th birthday.

“The five major trading companies have many joint ventures throughout the world and are likely to have more,” Mr Buffett said.

“I hope that in the future there may be opportunities of mutual benefit.”

The investment will help reduce Berkshire’s dependence on the US economy, which in the last quarter contracted the most in at least 73 years as the Covid-19 pandemic took hold. Many of its businesses have struggled, including aircraft parts maker Precision Castparts from which it bore a $9.8bn write-down.

Mr Buffett’s choice in Japan, however, surprised market players as trading houses have long been far from investor favourites. As well as significant exposure to the energy sector and resource price volatility, tangled business models involving commodities as varied as noodles and rockets have long been a turn-off.

“Their cheap valuation may have been an attraction,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ-Morgan Stanley Securities in Tokyo. “But it is un-Buffett-like to buy into all five companies rather than selecting a few.”

Berkshire bought the little-over 5% stakes in about a year through insurance business National Indemnity. Together, five 5% stakes were worth 700 billion yen ($6.63bn).

Firms’ shares often rise when Mr Buffett discloses investment, reflecting what investors view as his imprimatur. Marubeni and Sumitomo ended up over 9%, followed by Mitsubishi and Mitsui at over 7%. Itochu rose 4.2% to a record high.

Even so, Marubeni, Mitsubishi and Sumitomo are still 10% down on the year, versus a 6% fall in the Tokyo stock price index. Itochu, which has shifted towards consumer-related businesses, is the only one whose share price is higher than last year.

Indeed, Itochu is the only one whose stock trades above its book value. That means, for the other four, their market capitalisation is less than the value of their assets, making them attractive to a value investor like Mr Buffett.

Several have large amounts of cash on hand, raising their appeal.

Mitsubishi, for instance, has seen steady growth in free cash flow per share for four years.

Trading houses are also deeply involved in the real economy in areas such as steel, shipping, commodities, putting them on the radar of an investor such as Mr Buffett who famously avoids investing in businesses he claims not to understand.